Leverage Our Years of Experience

Over 80%

$84 Trillion

$114 Billion

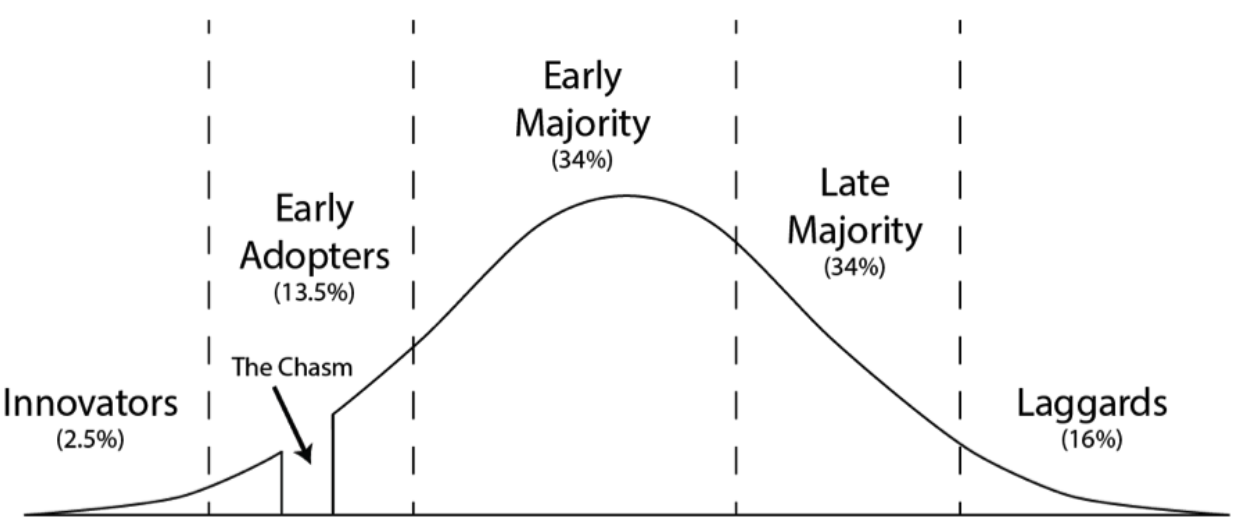

The Adoption is Happening

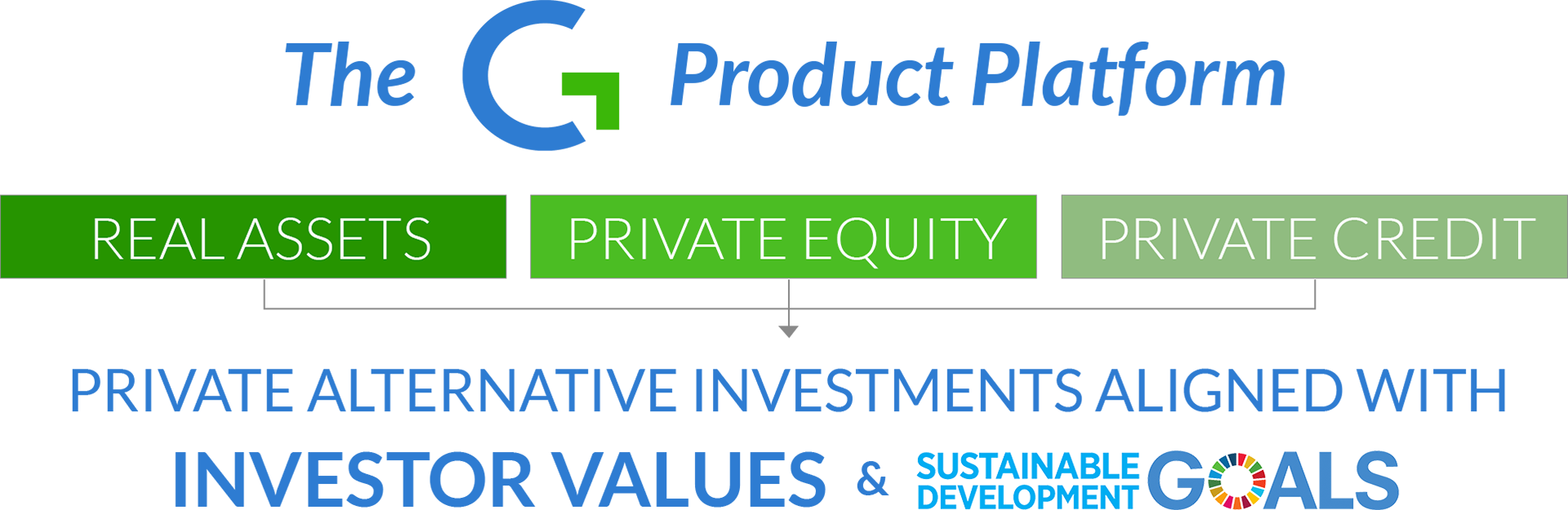

Impact Investing has gained significant momentum with Foundations and Institutions – the next frontier is individuals and families. Having a great idea or investment thesis is not enough. It takes experience, relationships, and a plan. Let’s build an industry together that can change hearts and the world. We are gaining momentum to cross the adoption chasm for individuals and families.

We’re doing our part…

asset managers advised

funds on platform

Million capital committed

Companies Advised

Private REIT created

Place Your Fund on Our Platform

Distribution & Capital Raise

Platform-partners access our team’s breadth of experience and skillsets committed to help grow their impact fund initiatives.

Fund Development

Fund Management

Due Diligence

Operation

Distribution

Compliance

Education

Marketing

Capital Raise

Investor / Advisor Relations

Investor Services

Investor Communication

Advisor Communication

À La Carte Services

Based on the specific needs of your fund, we can help you get to the starting line of your capital raise needs.

GO-TO MARKET SERVICES

As you prepare to go to market there are a number of very specific considerations based on the distribution channel best for you.

Channel Strategy

Product Structuring

Operations

Due Diligence

STRATEGIC MARKETING SERVICES

A strategic marketing plan that is focused, on message, compliant, and that properly educates, is critical to the overall success of a fund.

Messaging

Target Market

Marketing Materials

Launch Plan

Education

Campaign

Take the Next Step

Footnotes

[1] morganstanley.com ![]()

[2] cerulli.com ![]()

[3] businesswire.com ![]()

Related News

Three OZ Tax Forms You Need to Know

Initiated by the 2017 Tax Reform bill, Qualified Opportunity Zone Funds were created to encourage economic development in thousands of low-income areas across the United States and have unique tax-advantaged structures. As Opportunity Zone's are a relatively new...

QOFs Might Be the Answer

Volatility is upon us again. Has it been a catalyst for rebalancing, pruning, or repositioning? What do you do now? Did this trigger some taxable gains? Afraid to jump back into the stock and bond market? Well if your clients are sitting on realized gains and want to...

Facing Challenges Head On

As we close the books on the first quarter of 2020, from where I sit (Florida), it’s amazing how quickly things have changed from just a month ago when the hot topics of the quarter were US politics, Kobe Bryant’s passing, and climate change. In what feels like a...