SME Inventory Finance

An Innovative Approach to SME Lending

90%

The percent of businesses worldwide that are SMEs, which equates to 50% of the world’s employment and 45% of GDP. [1]

$1.7 Tr

The estimated gap between SME’s capital needs and the availability of capital caused by tight banking regulations. [1]

Fund Overview

TradeBacked Inc is a specialty finance company that provides asset-backed liquidity to cash flow-positive businesses. TradeBacked serves small and mid-sized enterprises (SMEs) needing short-term capital, funding the businesses in exchange for their inventory – mainly commodities. TradeBacked’s differentiator is its business model where it takes ownership of the inventory and its tailor-made insurance to provide investor protection. With over $200 million in deals in the pipeline, TradeBacked focuses on established SMEs having a minimum of $50 million in annual revenue. TB Fund 2 is offering (the “Offering”) prospective investors the opportunity to invest in Senior Secured Promissory Notes (the “Notes”).

SMEs play a significant role in most economies across the globe and yet in 2020 it was estimated that there was a $1.7T financing gap[3] for SMEs to grow their businesses. TB Fund 2 will provide capital for TradeBacked to use in the financing needs of select and approved SMEs.

Key Offering Terms [2]

- Fund – TB Fund 2 LLC, Series A

- Legal Structure – Senior Secured Promissory Note [4]

- Use of Proceeds – Engage in trade finance transactions and to pay the Company’s organizational, offering, and expenses.

- Target Fund Size – $10,000,000

- Note Interest & Term – 12.5% annually, 3 years [5]

- Min Investment – $50,000

- Interest Payments – Paid Quarterly [5]

- Suitability – Accredited Investor only

- Placement Agent & Fee – CommonGood Securities, 2% (not paid by investors) [6]

- Insurance Protection – Relm Insurance (Rated: A Exceptional) [7]

- Client (SMB) Insurance – Covers fraudulent activities, inventory, inventory price drop (residual), and other general insurance such as fire, burglary, etc. In short, investor protection. [7]

- TradeBacked Insurance – Covers D&O, E&O, Cyber, commercial crime, and client’s fraudulent activities. [7]

Fund Characteristics

Short Term Loans

- Self-liquidating loans made to SMEs with 90 -365 days maturities

- SMEs pay monthly custodian fees to TB Fund 2

- SMEs pays off loans at maturity in exchange for inventory collateral

- 25% maximum allocation to each company and commodity

Asset Backed & Insured

- Loans backed by inventory

- Physical ownership of commodities and title ownership of luxury assets

- Inventory hold in third party insured and bonded warehouse

- Loan to value 70-90%

- Bad actor and inventory insurance

Quarterly Interest [5]

- Interest payments paid quarterly on unpaid principal balance

- Term of note is for 12 quarterly payments or 3 years

- Tax reporting will be on a 1099INT

- Prepayment is allowed after a minimum of 4 quarters of interest payments

Investment and Impact Thesis

TradeBacked provides capital to the SMEs who need it but may be chronically under- served due to their size or jurisdiction. Performance will be driven in large part by making a positive impact with these SMEs and, indirectly, increasing employment opportunities with SMEs around the world.

- 70-80% Loan to Value (LTV)

- Inventory Ownership

- 3rd Party or Bonded Warehouse

- Insurance [7]

- Liquid Inventory

- Diversification

- Promissory Notes from SMEs

Entities of a Typical Transaction

The SME

The SME has inventory, but needs working capital for growth.

Warehouse Inventory

Per the agreement, TradeBacked owns the inventory and receives a monthly custodian fee.

Insurance Company

Protection via multiple layers of insurance, including inventory,

re-payment, and other types of risk.

TradeBacked

TradeBacked transfers ownership upon SME’s repurchase of the inventory.

Investment Consideration & Risks

The securities may be sold only to accredited investors, which, for natural persons, are investors who meet certain minimum annual income or net worth thresholds. The securities are being offered in reliance on an exemption from the registration requirements of the securities act and are not required to comply with specific disclosure requirements that apply to registration under the securities act. The commission has not passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials.

An investment in the interests of TB Fund 2, LLC is speculative and involves significant risk. Prospective investors should have the financial ability and willingness to accept such risks and the lack of liquidity that is characteristic of the investment. Potential investors should carefully review the “risk factors” beginning on page 16 in the private placement memorandum for a more comprehensive discussion of risks and suitability.

The company has been recently formed and operational for less than a year. Accordingly, the company does not have a substantial history upon which investors may base an investment decision and it may be difficult to effectively assess the company’s future prospects.

The company invests in trade finance transactions with companies that may have exposure to global emerging markets. Investments in emerging markets involves risks and special considerations that may not be typically associated with investing in more developed markets

The noteholders are not shareholders of the company and, therefore, shall have no voting rights or equity interest in the company. The only rights the noteholders have are set forth in the note each noteholder receives from the company.

The notes cannot be assigned, transferred, or encumbered except on limited terms and conditions. Accordingly, investors should only acquire the notes with the expectation of holding the notes through the maturity date. There is no public market for the notes, and none is expected to develop. Further. All transfers are subject to approval at the manager’s sole discretion.

Footnotes

[1] World Economic Forum,2022

[2] Please refer to the private placement memorandum for TB Fund 2 LLC, Series A for a full description of the terms of the offering.

[3] Asian Development Bank, https://www.adb.org/publications/2021-trade-finance-gaps-growth-jobs-survey

[4] Although each series of Notes will be secured by a distinct portfolio of assets segregated on the books and records of the Company, there is no guarantee that, in the event of a default by or bankruptcy of the Company, a court will honor such segregation of the Company’s assets into the various series.

[5] There can be no assurances or guarantees that: (i) the Company’s business strategies and plans will prove successful or (ii) an investor will not experience a significant or complete loss of their investment in the Notes.

[6] TB Fund 2 incurs a one-time placement fee from operating expenses.

[7] Although the Company actively seeks to acquire and maintain these insurance policies, there can be no guarantee that the Company will not experience an insured loss.

Related News

Africa was not at all what I expected…

Meeting students at a school in Musanze District, Rwanda The rains kept coming. As did the mud. And my doubts. Not at all what I expected. This is what kept going through my mind as we carved our way along the washed-out, jolting muddy roads 2 hours outside...

Jeff & Jonathan on the Nuance Podcast

Jeff and Jonathan Shafer were recently guests on the Nuance podcast, hosted by Dr. Case Thorp, to discuss impact investing, the intentional placement of one's investment capital in projects that both generate profit and positive social outcomes. The Shafer brothers...

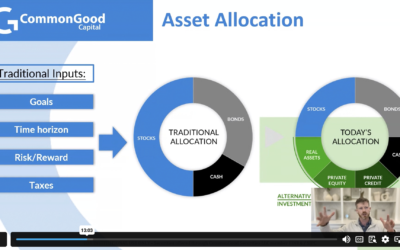

Advisor Webinar Replay: How to Select the Best Private Impact Investments for Your Clients

Do you want to get better at determining the most appropriate private values-based investments for your clients? Eagle Venture Fund hosted a special webinar featuring CommonGood's own Jeff Shafer and Stephen Hestor for RIAs and investment professionals that...