Why Impact investing?

Over 80%

$84 Trillion

could change hands over The Great Wealth Transfer in the next 25 years.[2]

only 12%

said they have heard about sustainable investing from a financial advisor.[3]

The Opportunity for Advisors

Impact investing represents an important opportunity for advisors to add value to their clients as well as attract transitioning wealth to your practice. Whether clients want to contribute to addressing the world’s social and environmental challenges, invest in their community, and/or are considering their legacy, impact investing can:

- Provide value that deepens existing relationships

- Retain clients as they lose a partner, age and transfer wealth to the next generation

- Differentiate your practice to attract new clients

- Attract top-notch young talent to your advisory team

“Impact investing is about connecting investors’ values and passions with their capital – putting their money to work to not only generate financial returns, but also joy through the creation of lasting impact in the world.”

Jonathan Shafer

What is Impact investing?

Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.[5]

Our Impact Framework

When assessing an Impact investment, these are the four key elements we evaluate…

Financial Return

Targets range from risk-adjusted competitive returns to concessionary levels below market rate

Intentionality of Impact

An ethos of creating positive social or environmental benefits for all stakeholders

Measurement / Reporting

Detailed and tangible disclosure of financial and non-financial outcomes

Sustainability

Meeting the needs of the present without compromising future generation’s needs

How do you start?

Much like Impact Investing in general, Integrating Impact investing requires intentionality…

Consider Who is Interested

Existing client behavior is a great indicator of clients who may appreciate Impact Investing opportunities….

- People who want to make money and do good

- People who want to leave the world a better place

- People who support institutions based on mission

- People who support institutions based on belief

- People who are concerned with climate change

- People skeptical of the stock market

- People who are already philanthropic

- People who are active church goers

- People who are healthy or vegan eaters

- People who are frequent International travelers

- People who express cynicism about big business

- People who enjoy volunteering

Start by Listening

Impact investing is a great way to create deeper, more meaningful intergenerational relationships with your clients. Here are 10 questions to help get the conversation started.

- Are you interested in becoming more connected with your investments?

- Is it helpful to know how your investments are impacting others/the environment?

- Are there any key issues that you would like to invest in?

- What does it mean to you to be a steward of your investment capital?

- Have you considered the non- financial outcomes of your investment portfolio?

- Is your capital doing what you want it to do for you and others?

- What does the power of capital mean to you?

- Do you have an interest to align your values and your investment portfolio?

- Have you heard of the sustainable development goals? (SDGs)

- What if you could invest in themes that align with your charitable dollars?

Continue the Journey by Learning

Impact investing is a great way to create deeper, more meaningful intergenerational relationships with your clients.

ALTERNATIVE INVESTMENTS: A SUPPLEMENT TO TRADITIONAL ALLOCATIONS

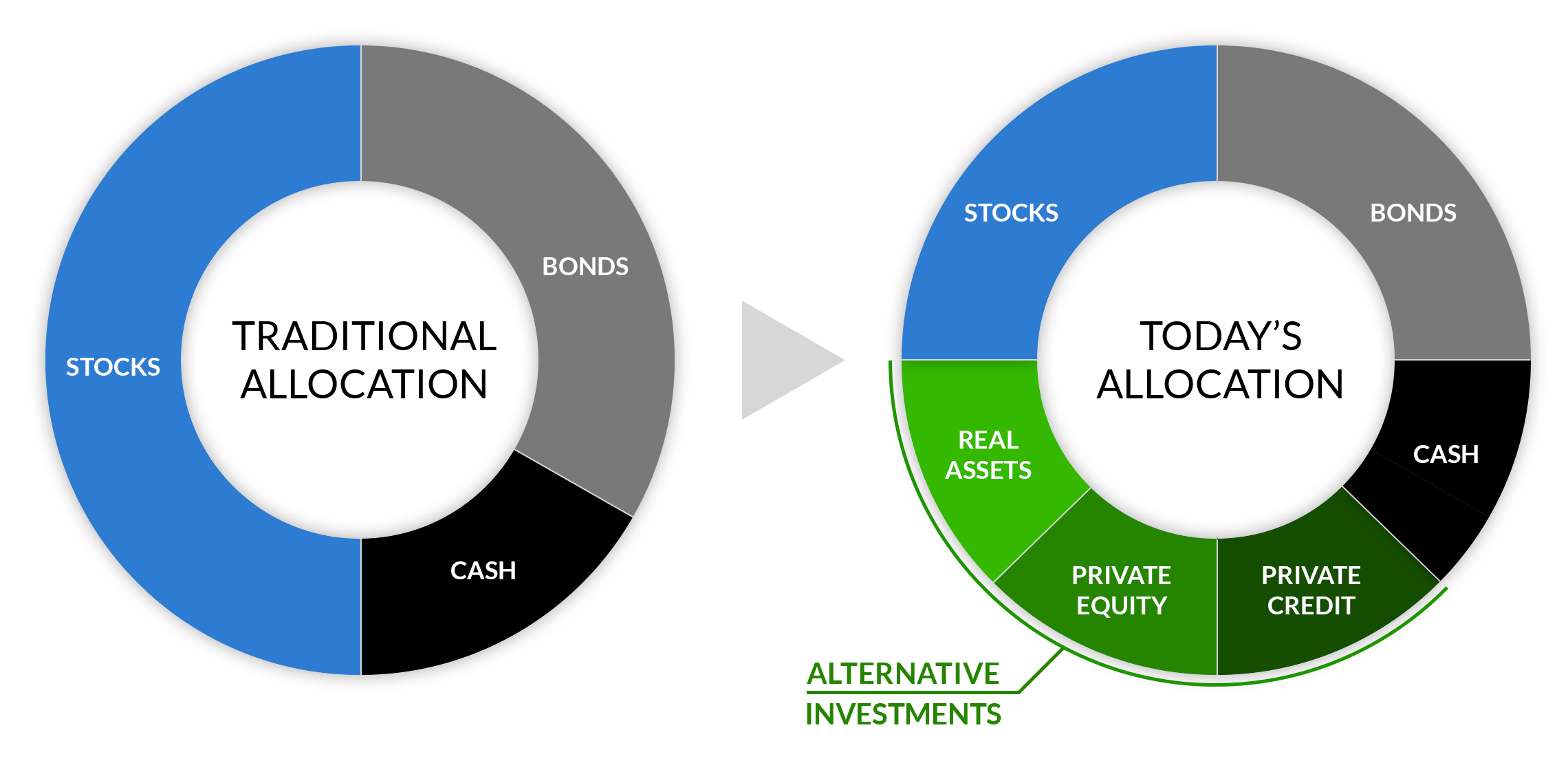

Driven by many inputs such as an investor’s financial goals, risk tolerance, and investment time horizon, asset allocation is a critical component of any financial plan. Traditional allocations were primarily customized percentages of stocks, bonds, and cash equivalents deployed through various investment wrappers such as mutual funds, ETFs, ETNs, closed-end funds, variable annuities, among others.

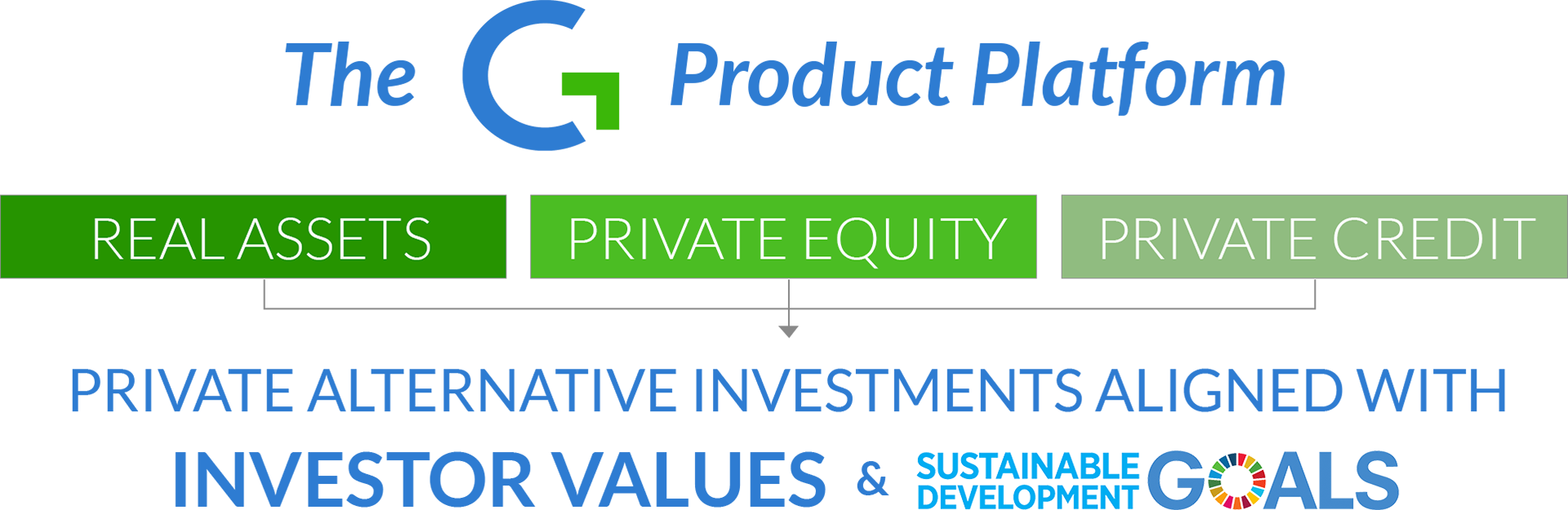

However, since the turn of this century, traditional allocations have been challenged and increasingly augmented via the implementation of alternative investments. This broad asset type had been widely utilized by institutional investors for decades, but has only recently been deployed in private investor portfolios. Today’s investors value alternative investments because of their return and correlation characteristics as well as the diversification they provide. At CommonGood, we think about alternative investments primarily residing in three broad buckets: real assets, private credit, and private equity.

IMPACT INVESTMENTS: A NEW LENS FOR TODAY’S ALLOCATIONS

Increasingly, investors and their advisors are searching for ways to align their values with their investments. Impact investing adds an additional lens to the allocation process, and places emphasis on the broader impact of our investments on society. Despite the desire to align their investing activities, investors and advisors continue to struggle to gain access to a sufficient flow of deals that have been thoroughly diligenced and researched. CommonGood’s expertise and passion is filling this void in the market in order to make it viable for advisors to consider values in the allocation process for their clients.

THE CommonGood PLATFORM

While we fundamentally evaluate each opportunity on its own merits, we also assess the totality of the investment offerings that we are compiling. In other words, the characteristics of each investment offering must be compatible and complementary to those it sits side by side with on our platform. As investment life-cycles naturally play out, our platform will regularly evolve with the addition and removal of offerings.

Footnotes

[1] morganstanley.com ![]()

[2] cerulli.com ![]()

[3] businesswire.com ![]()

[4] cnbc.com ![]()

[5] thegiin.org ![]()

Take the Next Step

If you are interested in learning more about integrating Impact Investing into your business please contact us

Related News

Africa was not at all what I expected…

Meeting students at a school in Musanze District, Rwanda The rains kept coming. As did the mud. And my doubts. Not at all what I expected. This is what kept going through my mind as we carved our way along the washed-out, jolting muddy roads 2 hours outside...

Jeff & Jonathan on the Nuance Podcast

Jeff and Jonathan Shafer were recently guests on the Nuance podcast, hosted by Dr. Case Thorp, to discuss impact investing, the intentional placement of one's investment capital in projects that both generate profit and positive social outcomes. The Shafer brothers...

Advisor Webinar Replay: How to Select the Best Private Impact Investments for Your Clients

Do you want to get better at determining the most appropriate private values-based investments for your clients? Eagle Venture Fund hosted a special webinar featuring CommonGood's own Jeff Shafer and Stephen Hestor for RIAs and investment professionals that...