CommonGood is a financial services firm aligning capital to facilitate returns, human flourishing, and meaning.

Financial Advisors

Create deeper, more meaningful intergenerational relationships with your clients.

Individuals, Families and Foundations

Create alignment with your capital and the local and global opportunities you care about.

Impact Fund Sponsors

Your source for advice and implementation of your impact investment opportunities.

Donor Advised Fund Providers

Bring Impact Investing to your donors from strategy to implementation.

Investment Banking

Capital Market services with a mind towards profits and the common good.

asset managers advised

funds on platform

Million capital committed

Billion DAF Consulting / Due Diligence

Companies Advised

Private REIT created

More Than an Investment

Investments can produce potential returns for your needs and dreams, but they also impact people, communities, and the planet. Your capital has the power to not only change your life, but also those around you- it’s more than just an investment.

CommonGood brings our expertise, experience, and passion for impact investing across real assets, private credit, and private equity. Within those asset classes we have several areas of focus.

Areas of Focus

- Housing

- Environmental Stewardship

- Small / medium business

- Africa

- Formerly incarcerated

Our world is hurting…

Capital has the power to change the world…

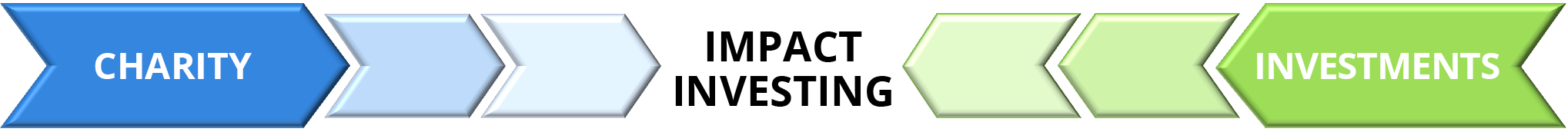

Capital is a tool and is used for good and for bad. The difference is the goal and the motives behind the capital. Imagine what would happen if we filled the gap between purely profit and purely charity. It would create another vision of success and undoubtedly unleash untapped creativity and innovation.

It’s the New Exchange

Historically, investing has been dominated by one major concept: risk and reward. However, in a 2017 survey, 75% of respondents said they were interested in investments that focus on achieving both financial returns and have a social or environmental impact. Impact investing is this New Exchange.

Trade fear and greed for joy and freedom

It is said that the markets run on fear and greed which are two natural emotions we have to deal with. But how do you move from fear and greed to joy and freedom? The key is to look beyond yourself. Align your capital with investment themes you have a passion for or care about. Let your capital work for you and for others.

CommonGood brings together a team of financial professionals with unique career paths and shared values to positively impact today’s transforming investment landscape and worldview.

Our Mission

To provide access and advisory services to Impact Investments that enhance both the financial goals and values of investors while creating meaningful impact in communities around the world.

Shelly Shafer on the joy found in Impact

Why Impact?

What is Impact Investing?

Investing in private investments with the intention of generating both financial returns and non-financial returns such as social, environmental, and spiritual.

Why impact investing?

Increasingly, investors are recognizing the power of capital and challenging the long-held views that investments should exclusively focus on financial returns with little regard for social and environmental issues. In addition, many recognize the shortfall that both non-profits and governments have to meet the ever-increasing needs and opportunities. In turn, it’s clear that business, done well, has the ability to impact people, planet, and profits for the common good.

It’s time for people to be connected to their investment capital. Every investor has their own risk, reward, and goals. With its unique and innovative approach to money management, Impact Investing allows investors to include their values and passions in their investment decisions.

Different types of Impact Investors

- Individuals

- Families

- Institutions

- Foundations and Endowments

- Governments

- Government Agencies

What are the elements of Impact Investing?

The key elements of Impact Investing are best described in an Impact Framework. This framework is important because it’s the working together of the four different pillars to enable the best possible long-term financial and non-financial outcomes.

- Financial Returns – Each investment needs to define the expectation of returns- from market rate to concessionary.

- Intentionality of Impact – Each investment needs stated objectives of positive social, environmental, or spiritual goals in addition to financial returns.

- Measurement/Reporting – Each investment must allocate time and resources to measure both financial and non-financial goals along with a transparent communication of the actual performance data.

- Sustainability – Each investment should evaluate their model and ability to meet the needs of the present without compromising the ability of future generations to meet their needs.

How do impact investments perform financially?

Where do I start?

The best place to start is to consider what Impact themes match your passions and values, then ask questions of your financial advisor, or feel free to contact us.

Some common Impact themes include…

- Affordable Housing

- Agriculture

- Communication Technology

- Education

- Energy

- Environment

- Financial Inclusion

- Green Real Estate

- Health

- Small & Medium Enterprises

- Sustainable Consumer Products

- Transportation

- Wast Management / Recycling

- Water & Sanitation

Latest News

Why I Went to Dubai

A couple of weeks ago, I hopped on a plane to Dubai to see for myself the inventory behind Tradebacked’s trade finance vehicles. We’ve been doing deep due diligence on Tradebacked for the past two years, and I’ve served on the investment committee for TB Fund 2—but...

Is 3D Printing the Future of Residential Real Estate?

CommonGood Capital recently hosted an engaging and insightful webinar featuring Zachary Mannheimer, founder and CEO of Alquist 3D. The discussion focused on residential real estate as an investment opportunity, exploring how the sector is evolving and where...

Pardon Me – Meet the newest “Czar”

I had never really thought about the history or details of the US President’s power to grant pardons. Rhythmically at the end of every 4-year Presidential cycle we hear about a bunch of pardons followed by the press’s praise or criticism of those they want to...

Podcast:

A New Lens

93 – Jeffrey Williams on Spaceflight, Stewardship, and Purpose

Jeff Shafer, CEO of CommonGood Capital, sits down with Colonel Jeffrey Williams - a retired U.S. Army officer and former NASA astronaut - to discuss how growing up on a farm shaped his view of work and capital, what it’s really like to live and work aboard the...

#92 – Lynette Khalfani-Cox on Unlocking Hidden Opportunity

Jeff Shafer, CEO of CommonGood Capital, speaks with Lynette Khalfani-Cox - a former Wall Street Journal reporter, CNBC correspondent, founder of a 22-year financial education company, best-selling author, investor, wife and mom - about how growing up with limited...

#91 – Michael Chernow on Entrepreneurship, Sobriety, and Discipline

Jeff Shafer, CEO of CommonGood Capital, talks with Michael Chernow, founder of Kreatures of Habit, about growing up in New York City and discovering entrepreneurship early, his path to sobriety and how small daily habits helped reshape his life, building and scaling...