Leverage Our Years of Experience

We help DAFs source, due diligence, and implement different Impact investments to meet the growing needs and desires of their donors.

Over 80%

$84 Trillion

could change hands over The Great Wealth Transfer in the next 25 years.[2]

DAF’s

DAFs are Critical to Impact’s Success

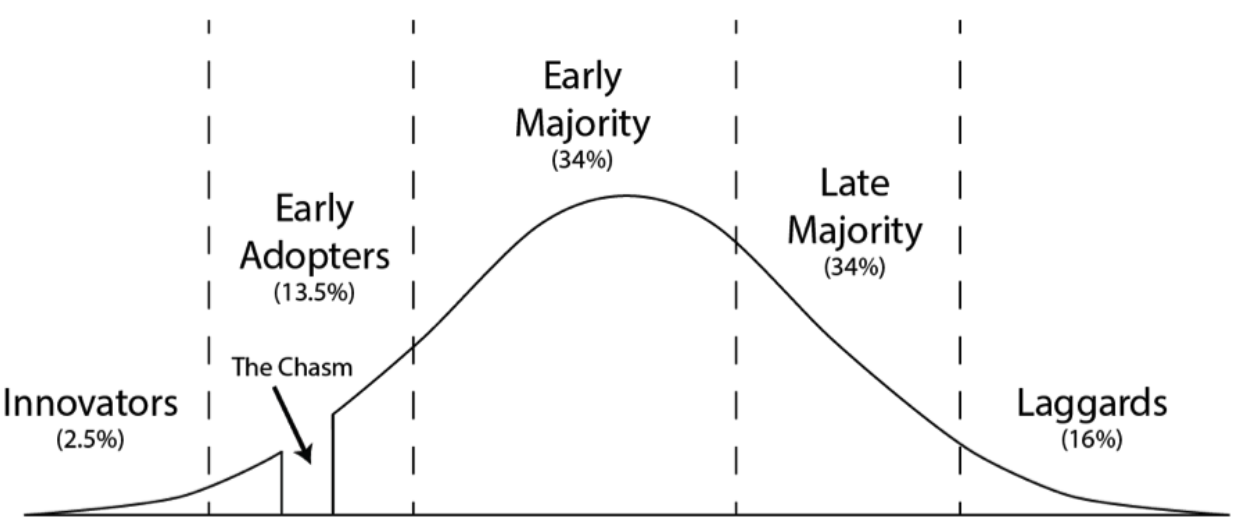

Impact Investing has gained significant momentum with Foundations and Institutions – the next frontier is individuals and families. DAFs can provide a unique access point to Impact Investing. To do this it takes knowledge, relationships, and a plan. Let’s build an investment experience that can change hearts and the world. DAFs are creating momentum to cross the adoption chasm for individuals and families.

Twice the Impact

Add value to your Donors by providing the oppourtunity for Impact while waiting to grant

The Opportunity for DAFs

Impact Investing represents an important opportunity for DAFs to add value for their donors and stakeholder by giving your donors the opportunity to contribute to addressing the world’s social, environmental, and spiritual opportunities twice. Once as they invest their DAFs capital and again, when they grant their capital. Impact investing allows you to:

- Provide value that deepens your donor relationships

- Give access, for the first time, to many of your stakeholders

- Differentiate your DAF

- Further align your DAFs mission to helping serve your donors and causes

Start by Listening

Impact investing is a great way to create deeper, more meaningful relationships with your donors. Here are 10 questions to help get the conversation started.

- What if you could invest in themes that align with your charitable dollars?

- Are you interested in becoming more connected with your investments?

- Is it helpful to know how your investments are impacting others/the environment?

- Are there any key issues that you would like to invest in?

- What does it mean to you to be a steward of your investment capital?

- Have you considered the non- financial outcomes of your investment portfolio?

- Is your capital doing what you want it to do for you and others?

- What does the power of capital mean to you?

- Do you have an interest to align your values and your investment portfolio?

- Have you heard of the sustainable development goals? (SDGs)

Take the Next Step

If you are interested in learning more about integrating Impact Investing into your DAF please contact us.

Footnotes

[1] morganstanley.com ![]()

[2] cerulli.com ![]()

[3] National Philanthropic Trust, 2021a ![]()

Related News

The Price of a Pandemic

Long before the CARES Act was first being discussed in the halls of Congress, we were closely monitoring the potential economic impact caused by the onset of COVID-19 and the subsequent steps taken by local, state and federal officials in response to it. Our outlook...

Key Updates From TriLinc Global

Gloria Nelund, Founder and CEO of TriLinc Global, and Paul Sanford, Chief Investment Officer, recently hosted a webinar on COVID-19 and the financial markets. The webinar offered commentary on the coronavirus’s current and potential impacts on TriLinc’s portfolios and...

SBA / SBIC Observations From Concentric Investment Partners

The Small Business Administration (SBA) was created to provide support to entrepreneurs and small businesses. This support is provided in a variety of ways, one of them being loans provided by Small Business Investment Company (SBIC) funds. These SBIC funds provide...