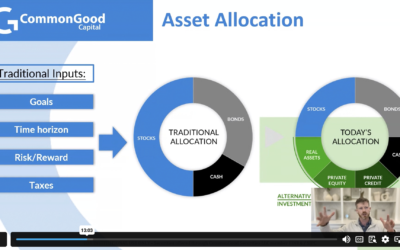

The Small Business Administration (SBA) was created to provide support to entrepreneurs and small businesses. This support is provided in a variety of ways, one of them being loans provided by Small Business Investment Company (SBIC) funds. These SBIC funds provide significant capital to small businesses, while the SBA provides loan guarantees, SBIC oversight, and low cost capital to the SBIC. As part of the recently passed CARES Act, the SBA authorized an additional $350Bn of capital for small to medium sized businesses impacted by the COVID-19 pandemic. This additional capital will not be flowing through SBIC funds, but will be targeted towards the same lower middle markets companies that may be struggling now more than ever.

“Coming out of the economic dislocation we are entering, there will be plenty of fundamentally sound small businesses that need capital; likely more than usual because of the economic dislocation. And there will likely be a relative lack of capital in the market as existing lenders and investors are focused on their existing portfolios and have likely invested some dry powder in them over the preceding weeks and months. As we are launching our SBIC fund, we will obviously not have to deal with this challenge and should be well positioned to aggressively pursue, win, and close good deals on attractive terms. In summary, I don’t think being an SBIC, specifically, will be more significantly differentiated than it already is but having a new fund investing in the lower middle market, generally, should be an attractive investment opportunity given the COVID-19 situation.”

– Corbin Graves, Concentric Investment Partners