During his campaign, President-Elect Joe Biden released a tax plan to, among other things:

- Revert the top individual income tax rate to the pre-Tax Cuts and Jobs Act level of 39.6%.

- Remove the preferential tax rate on long-term capital gains (“LTCG”) for taxpayers earning more than $1 million annually.

Each of these measures may effect investors with capital gains who are considering an investment in a Qualified Opportunity Fund(“QOF”). As a reminder, LTCGs have historically been taxed at a preferential rate of 20 percent for the highest earners. This proposal would tax the LTCG and qualified dividends of taxpayers earning more than $1 million annually at the ordinary income rate, as high as 39.6 percent.

The most significant tax benefit of a QOF investment is the elimination of any capital gain taxes on the QOF interest after a 10-year hold. If Biden’s proposal to increase the tax rate on LTCG is implemented and remains in place, this capital gains tax elimination becomes far more valuable, relative to both current tax rates and to a comparable investment outside of a QOF.

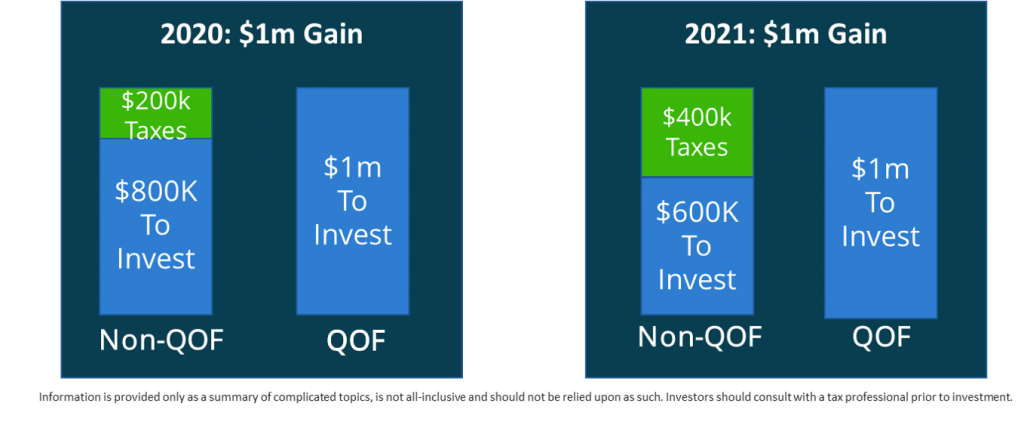

This change should also provide additional incentive to make a QOF investment for investors with capital gains coming next year. For example, someone with a $1 million capital gain would have a capital gains tax bill of approximately $200k under the current rates, but this proposed change essentially doubles their capital gains tax bill to $400k. That investor may potentially defer their additional $200k tax liability until 2026 by investing in a QOF. We can’t know for certain if these changes will be made or if they’ll remain in place until 2026 or beyond, but it’s important to realize that in many cases higher tax rates actually make OZs more compelling for investor rather than less.

We discussed this topic, as well as recently proposed OZ rule changes and OZ housing acquisitions, in our latest webinar. If you’d like to learn more, please click below for the replay…