ASI Multifamily Impact Fund, LP Acquires Crosswinds Apartments

The ASI Multi-Family Impact Fund, LP, which is focused on providing Affordable and Workforce housing primarily serving minority populations and lower income residents, recently acquired Crosswinds Apartments – affordable, 109-unit multifamily property situated in Chesapeake, a quiet suburban community located less than seven miles from downtown Norfolk, Virginia. Crosswinds is comprised of 8 two-story brick masonry garden-style residential buildings which includes a leasing office, with community amenities including laundry facilities, playground, outdoor covered mailbox area and picnic area/BBQ grills. Placed in service in 2004, the Property is subject to LIHTC Regulatory Agreements restricting 100% of the units to 60% of Area Median Income with 30 units or 28% of the tenant base receiving Section 8 vouchers. Click the button below to learn more about the Crosswinds property, or click here to learn more about the ASI Multi-Family Impact Fund, LP and feel free to contact CommonGood Capital for more information.

Footnotes

[1] National Low-Income Housing Coalition.

[2] Preserving Multifamily Workforce and Affordable Housing, Stockton Williams, Urban Land Institute.

[3] Please refer to the private placement memorandum for MFIF for a full description of the terms of the offering.

[4] While the Preferred Return is a term of the offering, there is no guarantee that there will be sufficient funds to pay the Preferred Return.

[5] Following the full return of invested capital and the Preferred Return to Investors, the GP will be entitled to 20% of any additional cash generated with respect to each investment, subject to a Catch-Up provision.

[6] (i) During the Investment Period, 1.50% per annum of Capital Commitment, and (ii) after the Investment Period 1.50% per annum of Net Invested Capital.

[7] Discount applies to first $5M of complete and irrevocable Capital Commitments received by the General Partner.

[8] Occupancy and collection data for the six properties in Alliant Strategic Preservation Fund II, Ltd.

[9] Housing Affordability And Children’s Cognitive Achievement, Newman and Holupka.

[10] Numbers stated include assets of funds owned by ASI’s affiliate, Alliant Capital, Ltd.

Related News

Celebrating 5 Years of Impact

At 40, as an executive at a leading alternative asset management firm, a back surgery forced me to slow down and become acutely aware of my own limitations physically, emotionally, and spiritually. Five weeks into that journey I sat at my couch and watched a DVD...

Come See Us at IPA Summit

Don't miss Jeff Shafer, CEO of CommonGood Capital on May 6th at 8:30am for a panel on ESG & Impact in Alternative Investments at the IPA Summit in Washington D.C. ESG and Impact Investing fall under the umbrella of Sustainable Investing. Already confused? With a...

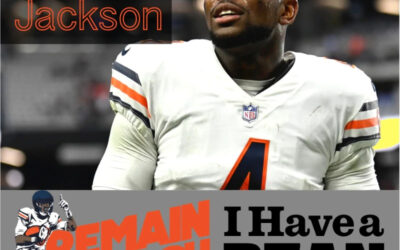

I Have a Bean Teams Up With Eddie Jackson

I Have A Bean, ® a Wheaton-based coffee company whose mission is to provide jobs and community for post-prison individuals (and that CommonGood Capital has invested in), has partnered with football star Eddie Jackson and his Remain 2 Reach foundation on two exclusive...