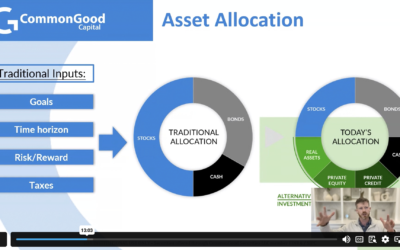

Prior to 2010, allocations to private credit in endowment or high worth client portfolios were rare. Today, strategies under this umbrella exceed $1.2 trillion in assets under management (AUM). Many average investors now have exposure through Business Development Companies, 1940 Act interval funds, and or recently developed private vehicles managed by Wall Street firms such as the Blackstone Group and Starwood Capital Group.

Rapid AUM growth in recent years suggests the embrace of private credit is in its early chapters. AUM expansion in Europe and Asia, for example, is now outpacing North America. Given over half of current AUM is based in North America, the potential globally is substantial.

Private credit’s formal inception is widely considered to be the creation of the U.S. high-yield market in the late 1970s and early 1980s. What is less known, however, is that there was simultaneously a very different origin story developing in private credit on the other side of the world…