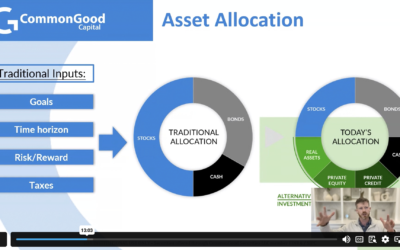

In light of the health and economic crisis we are in today, the need for private capital as a catalyst for good has only been amplified. Qualified opportunity zone funds (QOFs) remain a attractive option for investors to make an impact alongside financial gain and favorable tax treatment through the end of this year and likely even longer. You’ll need to consult with your tax advisor, but according to recently released guidance from the IRS, a potential investor with 2019 taxable gain whose 180 day window would have expired between April 1 and July 14, 2020 now has until July 15th, 2020 to make an investment into a QOF. In the midst of the current turmoil, this provides an extra window of time for investors to take advantage of this incredible tax incentive and roll gains from over 6 months ago into an opportunity zone fund this summer. I can’t imagine a better time for investors to start aligning capital with their values than right now.

Africa was not at all what I expected…

Meeting students at a school in Musanze District, Rwanda The rains kept coming. As did the mud. And my...