Leverage Our Years of Experience

Over 80%

$84 Trillion

$114 Billion

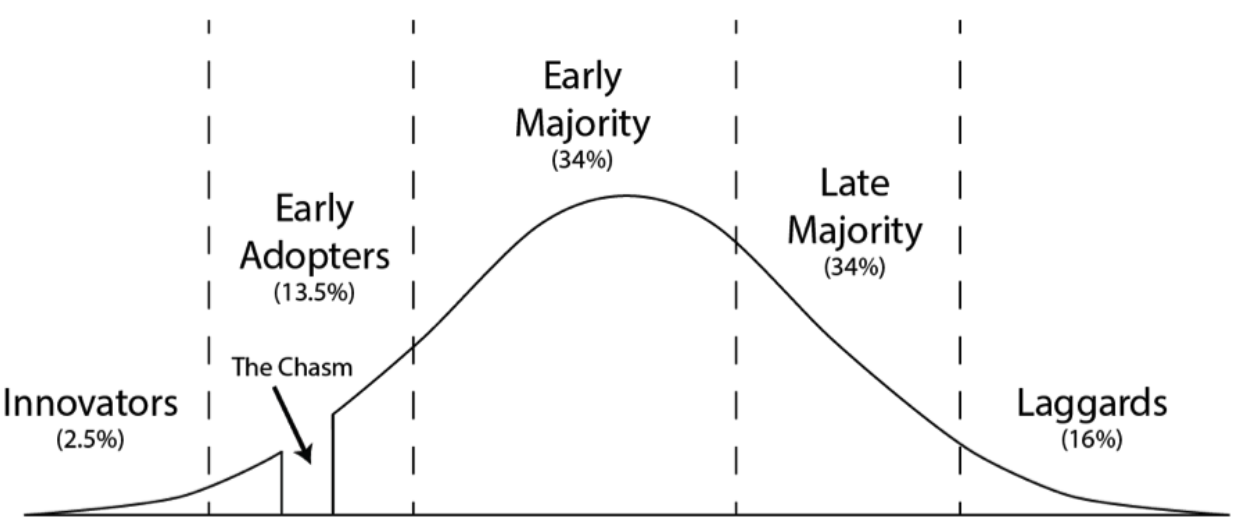

The Adoption is Happening

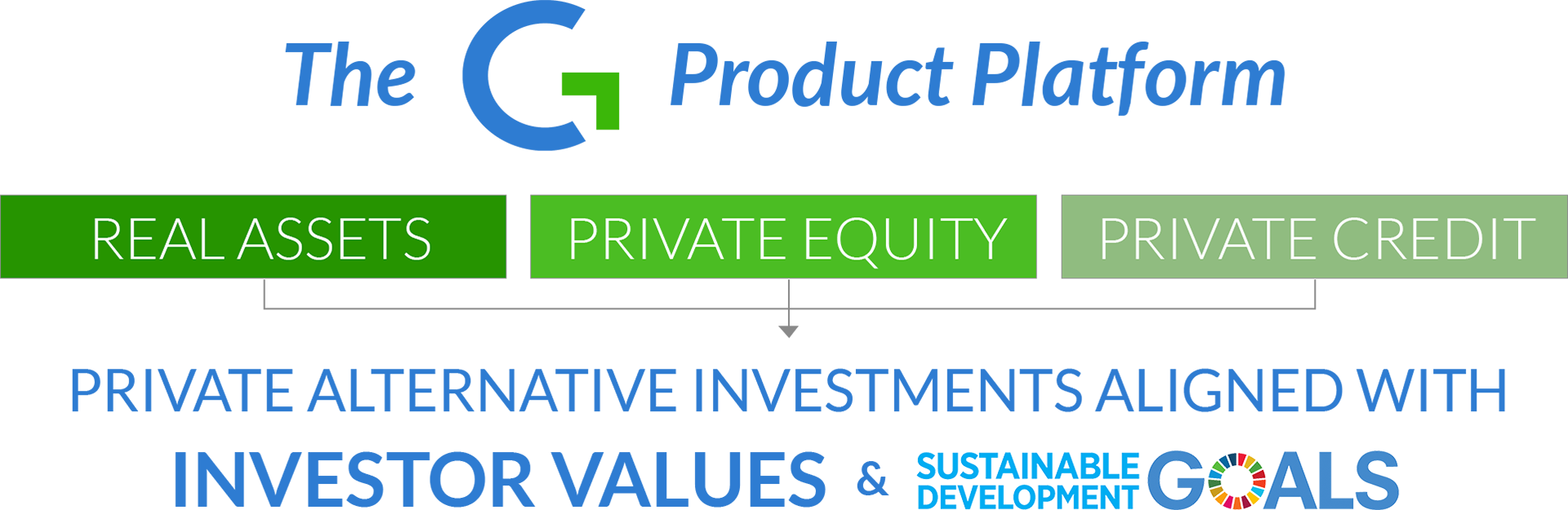

Impact Investing has gained significant momentum with Foundations and Institutions – the next frontier is individuals and families. Having a great idea or investment thesis is not enough. It takes experience, relationships, and a plan. Let’s build an industry together that can change hearts and the world. We are gaining momentum to cross the adoption chasm for individuals and families.

We’re doing our part…

asset managers advised

funds on platform

Million capital committed

Companies Advised

Private REIT created

Place Your Fund on Our Platform

Distribution & Capital Raise

Platform-partners access our team’s breadth of experience and skillsets committed to help grow their impact fund initiatives.

Fund Development

Fund Management

Due Diligence

Operation

Distribution

Compliance

Education

Marketing

Capital Raise

Investor / Advisor Relations

Investor Services

Investor Communication

Advisor Communication

À La Carte Services

Based on the specific needs of your fund, we can help you get to the starting line of your capital raise needs.

GO-TO MARKET SERVICES

As you prepare to go to market there are a number of very specific considerations based on the distribution channel best for you.

Channel Strategy

Product Structuring

Operations

Due Diligence

STRATEGIC MARKETING SERVICES

A strategic marketing plan that is focused, on message, compliant, and that properly educates, is critical to the overall success of a fund.

Messaging

Target Market

Marketing Materials

Launch Plan

Education

Campaign

Take the Next Step

Footnotes

[1] morganstanley.com ![]()

[2] cerulli.com ![]()

[3] businesswire.com ![]()

Related News

Fortis Green Acquires Rwaza Hydro Power Plant

Fortis Green Renewables, a US-based renewable energy investment firm, currently investing out of Green Fund I, recently announced the acquisition of a significant minority stake in Rwaza Hydropower Ltd (“Rwaza”), a 2.6MW operational run-of-river hydropower...

Context Matters: People Are Using Their Money to Help Find Meaning and Purpose

When I started my career in 1996, socially responsible investing (SRI) was the main vernacular and methodology used to describe screening out companies or “sin” stocks. Candidly, I was not really interested at that time. Then came ESG, but it was Impact Investing...

Jeff Shafer on the Avant-Garde Entrepreneur podcast

CommonGood Capital CEO Jeff Shafer was recently a guest on the Avant-Garde Entrepreneur podcast, chatting with host Trisha Bailey about investment readiness from the impact investor standpoint and the metrics, values, and opportunities impact...