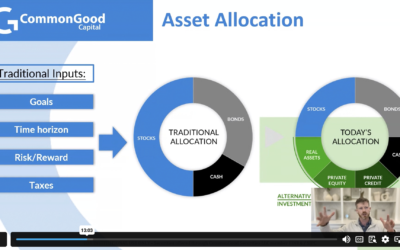

“Corporate behavior in a time of crisis—both in how companies treat employees and customers, and their impact on society in a time of need—can have lasting implications, both positive and negative,” says Jessica Alsford, Head of Sustainability Research at Morgan Stanley. “These factors can be linked to long-term performance and returns.” Now more than ever, we believe there’s a strong correlational between companies and investments that do good – those creating positive social, economic, or environmental impacts – and those that will perform well financially. At CommonGood, we’ve designed our due diligence process with this in mind. We employ a rigorous process centered around three key components designed to identify high quality values-based alternative investments.

- Investment: CommonGood’s primary focus is on the viability and attractiveness of the investment. Utilizing a combination of macro research coupled with fundamental financial analysis, we put all potential investment strategies through a detailed institutional-style due diligence process. We focus on industry research, competitive and regulatory analysis, and financial analysis and modeling.

- Values: CommonGood is committed to identifying investment opportunities that align with investor values. It must create an impact on our communities, society, and the world in a meaningful and measurable way. In the same way that we vet the investment strategy, we also assess the impact created. Assessing impact involves intentionality, measurability, reportability, scale and scope.

- Partner: CommonGood seeks out long-term relationships with best-in-class asset managers and investing partners. Prior to the establishment of a relationship, we will thoroughly vet the strategies, investment theses, character, team, track record, and commitment to impact of each of our partners.

Grounded decision-making and a commitment to responsible investing have become more important than ever. During this time of crisis and recovery, CommonGood continues to provide thoroughly diligenced, unique, and compelling impact investment opportunities.