In 2015, I was increasingly concerned with protecting the downside in our personal investments. At that point in my career, I had been in the financial services industry for 20 years. Nearly 18 of those years were directly involved in different types of real estate: restaurants, seniors housing, office and industrial, recreational real estate, and multi-family. All told it was over $20b, and I experienced firsthand how each of these types of real estate had their own unique characteristics from supply and demand, lease structures, access to capital, and risks.

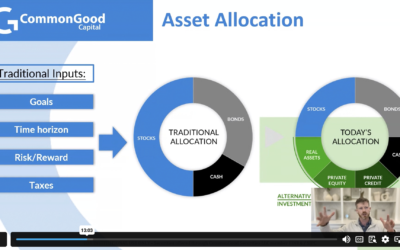

So, as I reasoned through protecting our downside, I started looking at investing in the base level of Maslow’s hierarchy: Physiological Needs. The next thing I considered was investing in those individuals or households who made up the largest income level; in 2015, 80% of households made below $110k, and 60% of households made less than $66k. Then, I looked at what is one of the largest needs and expenditures. That led me to shelter or housing. Finally, I made one last assumption – households were more likely to struggle with income growth versus making a windfall of money pushing them up and over to buying.

Ultimately, my wife and I made two investments at that time. One in manufactured housing and the other in Affordable Housing (or apartments). While in due diligence, I heard many compelling stats and stories, but it was hearing residents say, “They (management at these apartments) have given me my dignity back,” or, “I am so excited to have people come to my house now,” that opened my mind to another variable to consider while investing. How are our investments intentionally impacting others?

At first blush that does not seem like anything new, but when you incorporate intentionality, goals, measurement and reporting it influences the strategy and execution. We often forget that investing is more than just numbers, because those numbers are influenced and impacted by people. Practically, a key consideration for investing in rentals is the cost of resident turnover. Stop for a moment and consider what having happy residents does to that cost. Remembering that is a smart investment principle, but what shocked me was how it affected my wife and I. For the first time my wife was interested and engaged in our investments. And we both felt connected and joy to know that we were making money and helping others at the same time.

This exercise to help protect our portfolio seemed to be based on logic, experience, and analysis. However, I was profoundly reminded that the heart can play an important role in investment decisions. I will forever be grateful for those first two investments that I was drawn to by my intellect (or fear) and the words of the residents who inspired me to consider an investment variable that is too often left in the chest- the Heart.