Kiamahindu Hydrobox Run-of-the-River

Fund Overview

Fortis Green Renewables Green Fund I (“Fund”) provides capital for small-scale renewable energy assets in Sub Saharan Africa. The Fund invests in operational and development assets, each offering unique and potentially competitive return profiles. Green Fund I bolsters power to the national grid, establishes private grids, and directly supplies power to commercial, industrial, and household off-takers. The Fund portfolio is cultivated through strategic relationships and institutional co-investors spanning various countries, renewable energy technologies, and user bases.

6

African Countries

20+

Hydropower and Solar Assets

54 MW

Generated Power Capacity

40,600

CO2 Tons Reduction

Why Power for Africa?

Power is Transformational

Access to stable, high-quality, and clean power is foundational to economic and social development. 600M Africans (52%) still lack power access.[1] In its absence, economic growth slows and health & education outcomes decline.

Powering Rapid Growth

The second most populous continent is extremely young and growing rapidly. Its economies are getting stronger, and with over $500B needed to meet its power goals,[1] Africa’s power need is enormous and getting bigger.

Clear Market Opportunity

Green Fund I provides capital to small-scale renewable energy assets across Sub-Saharan Africa. This market has large capital gaps, which Green Fund I is addressing in order to unlock more clean power for Africa.

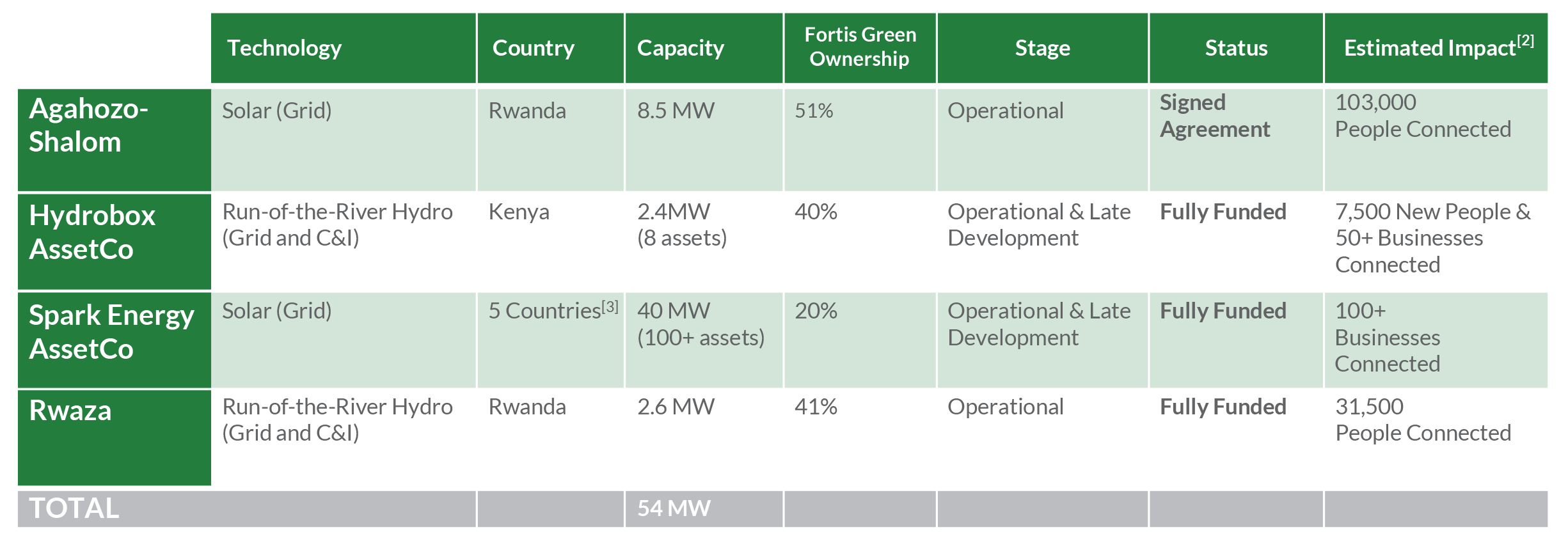

Asset Highlights

Hydrobox Asset Holding Company

The Hydrobox Asset Holding Company owns eight hydropower projects in Central and Western Kenya. Operating under an innovative ABC (Anchor, Business, Consumer) model, these assets sell the majority of their power to large Anchor customers, and to a lesser extent, to Business and Consumer customers. In addition to the potential for attractive returns, these assets aim to transform the region through access to affordable, reliable, and clean energy.

Rwaza Hydro Power Plant

The Rwaza 2.6MW Hydro Power Plant is located in Musanze District, Rwanda and draws water from the Mukungwa River through an environmentally safe weir and intake structure. Utilizing a 1km channel, the water flows to the powerhouse’s two turbines to produce clean and steady electricity for the country’s 13 million people.

Spark Energy Services Company

Spark will finance a portfolio of up to 40MWp in captive solar generation and energy efficiency projects in Africa’s commercial and industrial (C&I) sector – helping business, particularly SMEs, increase their overall competitiveness while achieving their low carbon growth plans.

Story of Impact

Central Highlands Tea, marketed under the Kiriti brand, is a farmer owned tea processing facility located in Central Kenya, in the foothills of the Aberdare Mountains. Employing 56 people and purchasing tea from 2,700 farmers, the factory plays a vital role in the local and regional economy. Faced with difficult access to reliable energy from the Kenyan utility, the tea factory was connected to projects jointly owned by Hydrobox and Fortis Green.

Key Offering Terms

- Strategy: Small scale renewables-based power generation, including solar, run-of-the-river hydropower, and wind.

- Geographic Focus: Sub Saharan Africa, with initial focus on East Africa

- Asset Class: Private equity and equity-like capital

- Fund Manager: Fortis Green Renewables

- Target Fund Size: $15M, with option to expand up to $25M

- Investment Size: Approximately 5 to 8 investments at $3M average ticket size

- Fund Term: 10 years total + 1 year extension (5 year investment period)

- Preferred Return: 8% annual return, cumulative [4]

- Management Fee: 2% management fee on commitments [5]

- Carried Interest: 20% over Preferred Return, with no catch-up provision [6]

- Legal Structure: Delaware LLC with potential Mauritius SPV

- Currency: USD, with USD denominated Power Purchase Agreements (”PPA”)

- Suitability: Accredited Investors only

- Minimum Investment: $150,000, subject to Fund Manager approval

Key Offering Terms

- Strategy: Small scale renewables-based power generation, including solar, run-of-the-river hydropower, and wind.

- Geographic Focus: Sub Saharan Africa, with initial focus on East Africa

- Asset Class: Private equity and equity-like capital

- Fund Manager: Fortis Green Renewables

- Target Fund Size: $15M, with option to expand up to $25M

- Investment Size: Approximately 5 to 8 investments at $3M average ticket size

- Fund Term: 10 years total + 1 year extension (5 year investment period)

- Preferred Return: 8% annual return, cumulative [4]

- Management Fee: 2% management fee on commitments [5]

- Carried Interest: 20% over Preferred Return, with no catch-up provision [6]

- Legal Structure: Delaware LLC with potential Mauritius SPV

- Currency: USD, with USD denominated Power Purchase Agreements (”PPA”)

- Suitability: Accredited Investors only

- Minimum Investment: $150,000, subject to Fund Manager approval

Fortis Green: Experienced Team

30 Years

Relevant Combined Experience

20 Countries

Investment and Operational Experience

$14.8 Billion

Combined Investment Experience

$7.4 Billion

Combined Power-Sector Investment Experience

Footnotes

[1] International Renewable Energy Agency

[2] Impact calculated as annual project kWh divided by relevant national per capita demand.

[3] Spark Portfolio will be in Kenya, Uganda Nigeria, Tanzania, and South Africa.

[4] While the Preferred Return is a term of the offering, there is no guarantee that there will be sufficient funds to pay the Preferred Return.

[5] During the Investment Period, the management fee shall be 2% of the total commitments. Following the Investment Period, the management fee shall be 2% of the investment cost basis.

[6] The GP will be entitled to 20% of any distributions in excess of the Preferred Return, with no catch-up provision. Carried Interest on distributions from liquidity events may only be paid following the full return of invested capital to investors. Carried Interest paid to the GP is subject to a claw-back provision.

Related News

Affordable and Workforce Housing Fund Officially Closed

The ASI Multi-Family Impact Fund, LP (MFIF), focused on the preservation of multi-family housing primarily serving minority populations and lower income residents, has officially closed. The fund is aimed at helping to fill the incredible demand for...

TradeBacked Completes First Repurchase Agreement

We are thrilled to announce the successful finalization of the first repurchase agreement in TB Fund 2. This significant milestone was unanimously approved by the joint TradeBacked and CommonGood investment committee, reflecting the commitment to excellence...

Fortis Green Acquires Rwaza Hydro Power Plant

Fortis Green Renewables, a US-based renewable energy investment firm, currently investing out of Green Fund I, recently announced the acquisition of a significant minority stake in Rwaza Hydropower Ltd (“Rwaza”), a 2.6MW operational run-of-river hydropower...